Ok, I don’t do this here very often, but I have to get some things off my chest. I believe most of you know that I have my own law practice focused on Wills, trusts, estate planning, probate, and business law. I’m going on 18 years of that and so far, it’s been a wild ride. I have enjoyed being able to help individuals and families navigate the toughest decisions and toughest times of their lives.

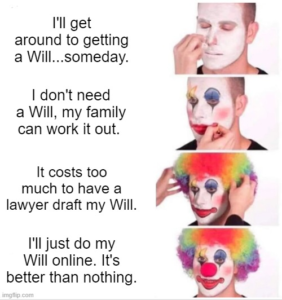

There have been a lot of trends I’ve seen through the years. One has been in the last 3-5 years, the probate process in Texas has become incredibly more difficult, expensive, and time consuming. But I’ve noticed a recent trend that is very concerning and very dangerous. As if it wasn’t bad enough to see people not do any Will or estate plan only to leave a mess for their family, more recently I have seen a huge increase in people using online or DIY legal planning. I see it recommended over and over again. I see people talking about finding the cheapest lawyer they can find, not realizing they are only creating more expense, time, and heartache later. And, of course, we still deal with our fair share of very well-meaning people who are committed to getting this planning done…but they just keep putting it on the backburner.

Friends, I am tired. My team at Burch Law is tired. Because we are the ones who are dealing with the fallout from people either not getting the planning done in time or trying to cut corners with DIY forms and cut-rate legal services. I completely understand that everyone is well intentioned, that they just don’t know. Well, I can’t take it anymore, so I’m committing to every day in August, yes 31 days, of sharing messages, resources, and education on the importance of getting your Will and estate plan in place, getting it done RIGHT, and getting it done NOW. I am not going to mince words and I’m not going to sugarcoat anything. There are going to be many who may not like what they are going to see…but it is the truth and it is reality. So this is your warning, if “you can’t handle the truth” then you may want to unfollow me now. I promise to still post about my adorable and perfect children, but if that is all you want from me, then you may want to take a break. For the rest of you, buckle up, this is going to be a bumpy ride.

Ok you were warned yesterday, that I was committed to 31 days of reality checks. So here we go…here is a mistake we see time and time again that people assume that their home will automatically go to their spouse. Yes, this is even if you bought the home together. Yes, this is even if both names are on the title. It does work that way in many other states…Texas is just not one of them. That means something needs to be done…whether it’s a Will, Trust, transfer on death deed, or survivorship agreement. There are several options depending on your wishes and needs.

Also, I am happily overwhelmed by the response yesterday, so I thank you! I will do my best to respond to everyone who asks a question or sends me a message, but feel free to email hello@burch-law.com to ensure to get a response from me or my team!

Have you ever noticed that all the online reviews for D.I.Y. Wills talk about how EASY it was and how INEXPENSIVE it was to do…but none of them address if they WORKED? Nope, no testimonials about how “easy” or “inexpensive” it was when it was actually time to use the documents!

As an attorney with decades of probate experience, I can tell you why: they hardly ever, ever, ever, ever, ever, ever work! Most of the time, they aren’t even signed properly, meaning you can’t use them AT ALL. There is no “close” in estate planning and probate. The rest of the time there are major things missed that sometimes cause even bigger problems than if you had no legal documents at all.

Here are a few, just a few, scenarios we see happen all the time with D.I.Y. Wills and legal documents:

Scenario One:

Necessary language left out of a deed for a living trust = Lost homestead exemption for years.

Scenario Two:

Husband assumed wife would automatically get all joint assets, so wrote Will to give his assets and property to his children = It is not automatic and wife survived, so all of his 50% went to the kids…not his wife.

Scenario Three:

Divorced mom of young kids does a Will with trust so her sister will control money until age 25 = She didn’t know to coordinate her life insurance policy beneficiary to her Will with the trust, so all of that money went into the court registry, the ex-husband was selected to oversee it (as the surviving parent), and everything was given to them when they turned 18.

Shall I go on? Because I can! In fact, stay tuned for many more reasons why D.I.Y. is D.I. Don’t!

If you want to join our Friends of Burch Law Facebook Group for more tips and information, click here: https://www.facebook.com/groups/1294416854460964

Waiting to get your Will done? Do you wait to put your seatbelt on until you’re in an accident? Do you wait to get homeowners insurance until it starts to hail? How would that work out? About as well as waiting to get this legal planning in place.

So, let’s talk about procrastination! Early on in my law practice I would hand out these round wooden coins that read “TUIT”. Get it? A ROUND TUIT! They were very effective and I should probably use them more!

The point is we are baffled by people who keep putting this off. They’re waiting for when they “have more time,” when they get their tax return, for when they know they’re done having kids, when they find out if they are moving in a couple years, when they have the perfect answers, when…fill in the blank. I’m especially surprised by the people who have taken the time to contact us, or have even met with us and been given a fully designed plan, but still haven’t started! I tell my team all the time that I would bet at least 80% of the people who have contacted us, but haven’t hired us, have still done NOTHING. They get surprised, but I know I’m right. All these years of experience, you know. They haven’t hired another firm, they haven’t made the horrible mistake of using online forms, no, they simply haven’t done ANYTHING.

Look, I get that this is HARD to think about, and I know that it’s difficult to know what the right decisions are sometimes…like who will take care of your kids, how do you want your assets distributed, who should make medical decisions, and so on. But the REALITY is…the TRUTH is…anything YOU DECIDE is BETTER than what the State of Texas will DECIDE FOR YOU!

Stop using “waiting” as an excuse and get this done NOW. You can always update and change it. What you will never be able to change is what will happen to your family if something happens BEFORE you make the time!

We don’t clown around at Burch Law. The message is simple: 1. Don’t wait, 2. Don’t leave a mess for your family, 3. Understand that the value of a qualified law firm far exceeds the cost, and 4. DIY legal documents are not “better than nothing”…they are worse, because at least people who don’t have a Will realize they don’t have one.

Did you know that a Will still has to go through a probate court process? Don’t get me wrong, I still recommend a properly drafted Will done by a qualified law firm as a foundation. But you are still setting up your family and loved ones for some additional costs, time delays, and lack of privacy with a Will. And probate in Texas in the last 5 years has increasingly become cumbersome and costly, which only compounds the grief and overwhelm for your family.

So why do a Will at all? Well, because it will be a lot LESS money, a lot LESS time, and, MOST IMPORTANTLY, you will be making all the choices rather than letting the State of Texas decide…such as who will take care of your kids and who will inherit your money and assets.

WITHOUT a WILL in Texas:

Average cost per person for probate? $7,000

Average time before you can gain access to bank accounts and sell or transfer a home? 9 months

Who makes all the decisions: The State of Texas!

WITH a WILL in Texas:

Average cost per person for probate? $3,000

Average time before you can gain access to bank accounts and sell or transfer a home? 3 months

Who makes all the decisions: YOU!

But…there are many options of avoiding probate all together. (For fans of the movie “Airplane!”, I hope that there are some of you saying in unison “there are many options of avoiding probate.”) A revocable living trust is one option. And, yes, it will cost more time and money now for you…to save a lot more time and money later for your family.

If you want to join our Friends of Burch Law Facebook Group for more tips and information, click here: https://www.facebook.com/groups/1294416854460964

You get a car seat even though you may never have an accident.

You get a baby gate even though they may never fall downstairs.

So why don’t you get a Will so that your child won’t end up in foster care until a judge decides who will take care of them, even if nothing may happen until they’re adults?

I warned you that I wasn’t going to sugarcoat anything. I know this may hit some of you hard, but I’m not just an estate planning and probate attorney, I am a parent too. And when I say I would do anything to protect them, I mean it. The reality is, I can’t make you feel guilty about anything, so if you are triggered by this message then I suggest you asked yourself “why?” before you dismiss it.

If you would like to join me for a live Online Information Session with Q&A tomorrow, August 8, at 5 pm, then register here: burch-law.com/info-session/.

It’s focused on Estate Planning Essentials for Parents, but I will cover information that will help all Texans. Join me!

I want to thank everyone who has been sharing these posts and reaching out. I’ve been asked several times about whether we can service clients outside of Texas (we cannot) and if I have any referrals. We do have a network of attorneys for those who want to reach out to us and ask. You can always contact local and state bar associations and, of course, ask around for who has had good experiences.

Regardless, just because a firm has their name on the list or you get several people who recommend attorneys, I wanted to take the opportunity today to discuss a few things you should always look for when choosing a law firm to draft estate planning document regardless of how much they are recommended. Whether you are looking for attorneys in Texas or in other states, here are some tips on what you should ask before hiring:

- DO YOU DABBLE OR DO YOU KNOW WHAT YOU’RE DOING? Make sure Wills, trusts, powers of attorney, and estate planning is at least 50% of their practice. That’s not saying an attorney needs to be “board certified” for this type of work. But the best ones have this type of law as a primary focus of their practice.

- IS THIS REAL WORLD OR EXERCISE? Ensure that they also practice probate. If they don’t know how Wills get interpreted by courts, then they really are just law students drafting your documents because they have no real-world experience.

- DO YOU JUST DRAFT DOCUMENTS OR DO YOU HELP ADVISE ON A PLAN? Ask if they will guide you on how to make sure your beneficiaries of life insurance, retirement, and financial accounts are set up in a way that will work with your wishes. Beneficiary designations override what a Will says and you want to make sure that everything will go to whom you want in the way you want it! For example, you do not want to name a child under 18 as a beneficiary on those type of assets, a good attorney will guide you as to why and what alternatives you have.

- IS THIS EVEN GOING TO WORK? Make sure you ask if they will help you with ensuring your documents get signed appropriately. I know that seems like a given, but many “cut-rate” law firms, legal plans, and DIY forms, don’t ensure that documents are signed correctly which means THEY WON’T WORK!

Read the full article: https://burch-law.com/how-to-pick-a-good-if-not-great-wills-trust-attorney/

Watch the video: https://burchlaw.dubb.com/v/0MhmQm

*sigh…why do people wait to get a Will, power of attorney, or estate plan? I know it’s not fun to think about and not really where you want to spend your time and money. But you know what else isn’t fun? Leaving your family guessing at your wishes or powerless to be able to act on your behalf.

Get your legal documents in place NOW. You can always change and update them, but what you cannot change is going back in time when it’s already too late.

All of our probate cases involve individuals who believed they had more time.

“I don’t have an estate.” “I don’t have any assets.” Those are some of the most common misunderstandings, or possibly excuses, we hear from people who are putting off getting a proper Will or trust in place.

First, as the meme suggests, assets aren’t just about money and stuff. An asset is anything that is uniquely yours that you want to protect. For parents who have young kids, regardless of how much money you have, a Will is critical to establish who can take care of them and who will oversee whatever money and assets you do have. Arguably, the less you have, the MORE VITAL it is to make sure that you have it set up in a way that will be less costly and time-consuming so that more money is available to take care of your kids.

I think what some people falsely believe is that the process for dealing with assets when someone passes away DEPENDS on the size of the estate and assets. That is not true at all. First, except in very rare circumstances, EVERYONE has an estate. An estate can be a house, a bank account, a car, a life insurance policy…anything in your name that would have to go through a process of being transferred, sold, or accessed when you die. And it’s not any different based on the value!

Meaning, in general, the process for a $100,000 and a $1,000,000 house is the same; the process for a $50,000 and a $500 car is the same; the process for a $5,000 and a $500,000 bank account is the same. Wills, trusts, and estate planning are NOT for the wealthy. This planning is for anyone who has something, or someone, they care about and want to protect.

So, yes, Virginia, you DO have an estate!

“Better than nothing.” We hear this a lot from people who have chosen some type of Will or estate plan “shortcut.” Whether it’s an online form, DIY kit, or note written on a napkin, there’s plenty of people fooling themselves that they’ve at least done “something.” The reality is it’s only better than nothing, because NOTHING HAS HAPPENED.

I often ask people if a parachute with a hole in it is better than nothing. Spoiler alert: it’s not, you’re still going to hit the ground…hard. So this got me to do some research about different types of parachutes. I ask you, for something as important as jumping out of a plane, which would you choose?

- A parachute with holes?

- A parachute with no holes?

- A tandem parachute that has a main parachute and a reserve parachute, and is designed to fit the jumper based on their height, weight, experience?

Or let’s talk about something else that has life and death consequences. Let’s pretend for a second that there are no safety regulations, which kind of car would you choose?

- A car with no brakes?

- A car with a brake pedal, but no air bags?

- A car with a brake pedal, emergency brake, and air bags?

By the way, they are all listed in order of cost. So, yes, #2 costs more than #1, and #3 costs more than #2. So if you’d pick #3 in both cases, then you obviously see that the VALUE, PROTECTION, and PEACE OF MIND far exceed the cost. It’s the same concept when getting your Will and estate planning in place. The problem is that a DIY Will, a “cheap” Will, and a Will done by a qualified law firm all FEEL the same to you. But they will feel VERY different to your family…and that’s when it truly matters.

Last question: if you knew that if you died unexpectedly that your young child would be in child protective services and possibly foster care until a judge decides who can take care of them, which would you choose?

- A DIY online form or Will kit?

- A Will done by the cheapest law firm you can find?

- A Will done by a law firm focused on estate planning and probate, that takes the time to get to know you, understands your needs and goals, and designed a customized plan?

The choice is yours, but don’t fool yourself thinking that anything less than the best value is “better than nothing.” It IS nothing. You deserve better and so does your family.

Special Edition: Common Probate Mistakes

Did you know that probate is like a group project? Here’s how: imagine you did all the work of going to a lawyer, getting a Will drafted properly, ensuring all your wishes are accurately outlined so that everything can be as easy as possible for your loved ones, you paid your money, you set it all up…only to have your family not use your Will when you die?

In Texas, you have 4 years after death to probate a Will and, remember, a Will has to go through a probate court process to be valid. Do you know how often people wait past 4 years? Waaaay too often! Why? So many reasons. One of the most common reasons is when you have assets like bank accounts and life insurance that all have beneficiaries on them, you will find that you don’t need a Will to gain access to those assets. But what about the house? Well, if your spouse or family keep living in it, paying the mortgage, paying the taxes, they have no idea that the title of the home isn’t in their name. If you remember in a previous edition of #31DaysofTruth, we discussed how in Texas, a home doesn’t automatically go to a spouse, even if they both own it and both names are on it. Then the problem comes when you either try to sell, refinance, or the most common scenario, when the surviving spouse passes away. You then think you only have to handle things for them…until you find out that nothing was done for the other spouse when they passed away…more than 4 years ago!

What are other reasons people wait to probate a Will? These are some of my favorites: the bank told them they didn’t need to; their neighbor told them they didn’t need to; their sister’s cousin’s best friend who is a financial planner in Arizona told them they didn’t need to…you get the idea.

What happens when you wait more than 4 years? Well, it’s presumed the Will was revoked and you must show a really good reason why you didn’t probate. And Texas judges are getting more and more strict on what reasons they’ll accept (hint: the sister’s cousin’s best friend is not good enough). There are different alternatives you have depending on the situation, but none of them are as easy, simple, or cost effective as having probated the Will before the 4 years was up.

Best advice: if a loved one passes away and/or you are named as the Executor in someone’s Will, set up a consultation with a probate attorney as soon as possible, even if you are 99.9999999% sure you don’t need to do anything. More often than not, something may come up.

People sometimes say that the cost of getting a Will, trust, or estate plan in place is more than they can afford. Believe me, I understand that the fee to do this planning the RIGHT way is not exactly what I call “couch cushion money”. (As in, change you can find in your couch.)

But that’s also the point: If you own a home, a car, a bank account, then the cost of doing nothing is much higher than that of getting a Will in place. And your family is going to have to agree on a lot of things without a plan. Furthermore, it can easily cost $7000 and take several months for anyone to even start to do things, such as access accounts, sell homes, pay off expenses. We see many situations where families must fundraise to be able to start!

The reality is, yes, it is an expense worth considering and if you aren’t able to figure out a way to pay to do it properly, then you are only passing down much more in money, time, and heartache. There are many firms that are happy to work out payments and other options.

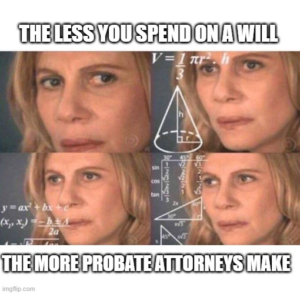

Be honest, have you ever thought that the only reason attorneys tell you that you should get a Will and estate plan through a law firm is because that will make them more money? No? Then great! Read no further. But for those cynics out there who think that all we’re trying to do is make a buck, then I’ve got news for you:

Attorneys make MORE money in probate when you spend LESS money to plan!

Whether it’s a DIY Will, a “free” service offered through your work, or the cheapest lawyer you could find, you are almost guaranteed that MORE money will be spent cleaning up the legal messes an inadequate plan creates.

The problem is that a DIY Will, a Will done by a cut-rate law firm, and a Will done by a qualified, experienced law firm all FEEL the same to you. Your family is who will feel the difference…and that is when it matters!

When we meet with clients, they will often say that they just want to spend as little as possible. I totally get it! My follow up question is: now or later? Because the reality is those lawyers are gonna get your money sooner or later…wouldn’t it be better to give them as little as possible AND make sure your family isn’t left with a mess?

This one is for my fellow Gen Xers who remember this commercial! So, we’ve discussed this before, and it’s one of the biggest reasons I started this 31 Days Crusade. Friends, friends, friends, DIY is NOT saving money or time. And in many cases, it will make things worse. Like the husband who assumed the home and assets would go to his wife, so he wrote his Will to give everything to his kids. He died, wife survived, his 50% went to his kids!

Today, I am announcing a brand-new program through Burch Law. We will make announcement later, but we are on a mission to Save Texans from the Dangers of DIY Wills…

Stay tuned for the announcement…in the meantime, for more information: https://burch-law.com/diy-wills/

Those who know me, know I had to acknowledge today, the 46th anniversary of the death of the King of Rock ‘n Roll. This has always been one of my favorite Elvis quotes and I used it as my quote in my college yearbook.

Estate planning is often called “legacy planning.” And while one definition of “legacy” is “the assets and money that one leaves behind”, it is also defined as “the long-lasting impact of one’s life.” Think about that for a second. How do you want to be remembered? What impact to you want to leave on your family and loved ones? Do you want them to remember being left with a mess of expenses and court delays? Do you want them to remember how you didn’t plan for anything, so they had to figure out how to pay bills, get into bank accounts, how to get the house title in their name? Do you want your legacy to be loved ones who won’t even talk to each other anymore because of how they fought when you passed?

We hear so often “my family can fight over it”, “they’ll figure it out”, “I don’t have that much, I don’t care if it goes to the state.” If that how you want to be remembered, then that is your choice. But for the rest of you, “It’s Now or Never”, so “Don’t Be Cruel” and get a plan in place TODAY!

To see a copy of Elvis’ Will (Yes, a celebrity with a Will!), check out https://www.ibiblio.org/elvis/elvwill.html

The One About Divorce: Ok, so this one comes to us by request: What should you do after divorce. I get it, some of us need a starter marriage. Or, if you’re Ross, several. When it comes to Wills, trusts, and estate planning, here are a few things to consider:

- You can and should update your estate planning as soon as possible, even if the divorce isn’t final. If your Will, trust, medical and financial powers of attorney, all list your soon to be ex-spouse as your primary decision-maker, you may want to change that to someone you trust more. No, your spouse does NOT have automatic rights to be the first one to make medical and financial decisions. That’s why married couples need this planning. So, even if your divorce is pending, if you have an emergency, you may have someone else you’d prefer to act on your behalf. And, once you’re divorced, you’ve already gotten this taken care of, so one less thing to do as you start your new life.

- If you don’t have a Will or estate plan, now is a GREAT time to get it done – even if the divorce isn’t final. Just like above, you don’t have to wait for your divorce to be finalized to get your Will, trust, or powers of attorney in place and you don’t have to name your ex-spouse. The downside is if you have NOTHING in place and you have an emergency, even though it’s not automatic, your soon to be ex-spouse is most likely to be the first one a court would choose, or a hospital would listen to.

- Guardianship – we get asked this one all the time. And while it’s unlikely you can prevent your ex-spouse from being the guardian of your child if they are also the legal parent, what you can do is prevent your ex from controlling any money and assets you leave behind for your child. You are able to have everything (life insurance, retirement, house, bank accounts, etc) go into a trust to be used for your child and you pick who you want to oversee it…and it does NOT have to be your ex. As for guardianship, it’s still a good idea to name a back-up guardian to your ex in case something happens to them and they do not have any alternates named.

- Now, all of this is contingent on what your divorce decree says as some financial obligations are often part of those arrangements. It’s important to make sure your estate planning attorney knows about those agreements so they can determine if anything needs to be incorporated into your estate plan.

- If you still want your spouse to make decisions for you AFTER divorce (hey, may sound strange, but we see it happen), you will still want to update your Will and estate planning documents because they law will disqualify your ex-spouse once you are divorced.

Want to know more? https://burch-law.com/contact

So how much should it cost to have a Will, Trust, and estate plan? Fair question and the fees can vary, which is why I created the handy dandy chart below. It gives you a general overview of what to expect and what you get depending on your plan. Now the fee ranges are approximate, and each case is different, so you could expect less or more depending on your needs and goals.

The biggest takeaway is to look at the costs of NOT having a Will or Trust. It is always going to be more expensive, more time, and more heartache. And it’s interesting when we talk to people, because many say, “I thought it would be more”, and others say, “that’s about what I expected,” then we get some who say, “that’s expensive!” Our question to that is: expensive compared to what? Enter The Chart!

And I know that it can seem like a lot of money to get this planning done the RIGHT way, but it’s so much less than it will be when something happens. Think about homeowners’ insurance where you pay a few thousand dollars (or more) EVERY SINGLE year just in case something happens in that year. And if something does, there’s a big deductible. But it’s worth it because if something does happen, it will save so much more. This is similar. Isn’t it worth paying that amount one or even a few times in your entire life to avoid an expensive and prolonged probate court process?

To get an estimate: https://burch-law.com/contact

The screenshot you see is from the website of a leading DIY Wills website. If this doesn’t frighten you, it should. While the information provided is SPOT ON as to the downsides of DIY legal planning, it’s shocking to me that a business would have a section on their site dedicated to why using their business is a bad idea. That alone should cause you to pause.

I would never put on our website “why it’s a bad idea to hire us”…mainly because it’s never a bad idea! But in all seriousness, if a company needs to have a CYA like that on their site, perhaps DIY is a big DI Don’t!

Have a DIY Plan and want to know if it will work BEFORE it’s too late? https://burch-law.com/diy-wills/

Special Edition: Common Probate Mistakes Part II

When someone dies without a Will or estate plan, it’s called dying “intestate.” So what do you do if that happens? Well, there are a number of options that only a qualified probate attorney should walk you through, but in Texas, here are a few of the options:

- Determination of Heirship and Appointment of Administrator

- Small Estate Affidavit

- Affidavit of Heirship

What do all of these have in common? Well, for one, the result will be the state of Texas will decide who inherits your money and assets regardless of what your wishes would have been. Also, your family history, assets, and debts will all be a public record. But do you know what else ALL these options have in common? One to two people who know you have to be willing to either sign a sworn statement or testify in court that they 1. Know you, 2. Know your marital history, 3. Know any and all children you had, including any you may have given up for adoption or terminated parental rights for, 4. Know an overview of your assets, and 5. Know about your debts. Now I have some good friends, but this is asking a lot. And in many of our cases, this becomes a huge issue that can either delay or prevent being able to sell a house or access a bank account.

If you want to join our Friends of Burch Law Facebook Group for more tips and information, click here: https://www.facebook.com/groups/1294416854460964

I’m going to do a little theme this week about what your family goes through when you’re gone and your legacy. Today is about how mad, yes, mad, our probate clients can be at their loved ones, because they never got a plan in place.

"I tried to get my mom to do this, but she just never wanted to talk about it. Now we're going to have to try and raise money to pay for probate since all her accounts are frozen."

"What do you mean I have to give half of everything to my stepkids? They didn't even talk to their dad!"

"We had met with a lawyer, but we just thought it was too expensive at the time. And now I'm paying 3 times that much just to sort this mess out!"

"We really thought an online Will was better than nothing, I can't believe that it's not even valid so we can't use it!"

"I had been trying to get my husband to do this since our first child was born, but he didn't want to talk about it. I can't believe I'm in this position now to deal with all of this while I'm trying to grieve him and take care of our kids."

"I'm angry at him for leaving us in this position!"

"I'm frustrated that we have to go through this process!"

These are just some of the many things we hear over and over again. The sad reality is that most people die without any sort of Will or estate plan. And for many of those who do have a plan, it was done online or in as least expensive way as possible…which leads to a lot of money, time, and heartache for your family later. They’re trying to grieve and work through the tremendous loss, but instead, they’re having to jump through legal hoops, pay for an expensive probate court process, experience massive time delays, and deal with family infighting. It’s truly heartbreaking and I’m certain it’s not the type of legacy they wanted.

Do you ever think about what your legacy will be when you’re gone? When it comes to Wills, trusts, and estate planning, you hear a lot about leaving a legacy. And, sure that includes ensuring that the money and assets you’ve worked hard for will carry on to your loved ones. A legacy is also defined as the “long lasting impact of one’s life.” Maybe you haven’t thought about it that much, but that is actually the kind of legacy we see all the time in the probate biz. What your family and loved ones will go through when you pass away is part of your story, part of your legacy.

Here are some of the good stories we here when the planning was done and done right!

"My mom made this so easy."

"I never thought this would happen so soon, but I'm so glad that we did this ahead of time."

"We are planning a trip to Hawaii next month to scatter his ashes. Have this all planned has made it so much easier for me and the kids and we can focus on healing."

If you want your loved ones to be able to focus on their grief and not legal barriers, if don’t want your family fighting and being angry at your lack of planning, if you want a legacy that tells the story of how much you loved and cared for them, then get a thorough and comprehensive estate plan NOW by a qualified law firm…before it’s too late!

Questions? To get an estimate: https://burch-law.com/contact

Ok, I’ve been on Friends kick, but there is just so much material. Like I mentioned yesterday, I’m taking this week to discuss a special theme of how estate planning is telling your story, your legacy. The fact is, IT COULD HAPPEN to you…what do you want your story to be?

Many people put off getting a Will or estate plan because they just don’t accept the reality that anything could happen, and they think they’ll have more time. But we hear stories every day of the unexpected happening and now it’s too late.

Parents get into a car accident while running errands and now their children are in foster care while the families fight over guardianship.

A young woman has a heart attack and now her wife is fighting with her family about whether to keep her on life support.

A college student has to be rushed to the hospital for an emergency appendectomy while at school and the hospital won’t tell the parents anything about her condition.

An elderly parent falls and is nonresponsive and now her adult children can’t get her to sign any paperwork or tell them where important documents are located.

A dad gets a cancer diagnosis and now they’re scrambling to get things put into place, but there is just no time before life-saving surgery.

These are the stories of what happens to real, everyday people who also lived as if they were immune from these realities. So if you are reading this, it means YOU still have time. What do you want your story to be?

Questions? https://burch-law.com/contact

Ok, I had this on my list to do a couple weeks ago, but this situation has popped up at least 3 times just THIS WEEK! Sometimes in the ol’ law biz, I lose sight of what is and is not common knowledge. It always shocks me when people contact us asking to get a Will, trust, or a power of attorney for a loved one who has dementia, is in hospice care, or otherwise has a mental incapacity. Therefore, they cannot communicate, express their wishes, and they definitely are not able to sign any paperwork.

The standard to be able to sign a Will in Texas versus a legal contract is a bit lower called a “lucid interval.” My go-to joke is “I’m still waiting for my first one!” (Can you hear the Burch Law office groaning after hearing that for the millionth time?) Even at that, we still get far too many folks who are just not able to understand, communicate, or sign any of these necessary legal documents.

So since this comes up so much, I have come to terms with the fact that despite what I would think, it is NOT common knowledge that all of these estate planning documents have to be signed by the person giving the power to others to act on their behalf. Not only that, but the documents have to be signed in front of witnesses or a notary or both! This is often a much bigger feat than you may realize and, unfortunately, in many cases, it is just too late.

Lesson? DO NOT WAIT! It’s like trying to put on a seatbelt while you’re in an accident or getting homeowners insurance in a hailstorm.

Questions? https://burch-law.com/contact

I wasn’t sure what I was going to do today, but I knew that it would have to be about what loved ones go through when someone passes away and what that person’s legacy means.

You see, 19 years ago today, August 24, 2004, my sweet and kind stepdad, Lee High, died suddenly and unexpectedly at 63 years old. When I got the frantic call from my mom, I was on my way home from work in Washington, DC. I had moved there for law school and I had actually just arrived back after visiting them here in Dallas, and I was thinking about moving back here, to be with them, to start my own law practice focused on Wills, estate planning, and probate. In fact, on August 23, 2004, I had my last phone call with my dad. He had gone and looked at apartments for me because he was so excited that I was thinking about coming home and he found the perfect one. The next day, he was gone. Three weeks later, I had permanently relocated back to Texas to start a whole new life under the cloud of tremendous grief. But I did move into that apartment he found. And I sit here 19 years later, still not able to hold back the pain of those days. That loss, that grief, it doesn’t go away and it doesn’t get better. You just learn to live with it. It becomes a part of your reality, part of who you are, part of your story.

I often think about one of the most impactful statements a probate client said to me once, a man who was so anguished by the loss of the love of his life, a woman who had a second chance at life after her divorce, who found this man, and with what little time they didn’t know she had left, they lived it to the fullest. He shared with me the wonderful slide show he made for her and I remember watching it alone in my office with tears streaming down my face. So many smiles, so many adventures. But at 55 years old, she was gone. We were sitting at the probate hearing and I was talking about how, as her executor, he would need to close her bank accounts, transfer her home, and cut off her credit cards. He just sat there, the pain so clearly all over his face and said to himself as much as he was saying it to me, “it feels like I’m erasing her.” I just ached for him. I’ve never forgotten the way he put it.

I think about my stepdad and how every year I remember all the things that surrounded that day. I remember when I had just visited, I walked into the house, and there was a box of my favorite cereal, Cocoa Pebbles, and he had made my favorite dessert with gooey coconut and chocolate cake…the same dessert he made the very first time we went to his house when he first started to date my mom, and I fell in love with that dessert. And with him. We all did.

I think about how much he loved the Mobil Oil Pegasus, the company he worked for and moved us all over the world, and how he had so many things that had that Pegasus on it. I look around my office and see the majority of his Pegasus stuff, because my mom gave it to me. I remember seeing the Pegasus on top of the Magnolia building downtown when I had to sit for the Texas bar exam after he died and how I felt like he was talking to me telling me everything was going to be ok. So the Pegasus became a vital part of my law practice, my new life, my reinvention. I think about my first-born daughter, Adlee, and how her name and the spelling of her name is for him, Lee. A-D-L-E-E. So sure, there are no bank accounts in his name, no home, no property, or assets. But he is far from erased.

I think about how I started a law practice focused on Wills, estate planning, and probate in the wake of his loss. And while I didn’t choose that area of law because of that experience, his loss set the tone for how I see all our clients. All our clients from 2005 all the way to now. And I want them all to know that they aren’t alone in this process, I see them, they matter, their loved ones matter. I’ve been very fortunate to find a team of people at my firm whose values and mission are the same.

So that is the Truth, the Reality, I have to share with you today. It’s very hard to have to plan for the end, but it’s coming, perhaps unexpectedly and prematurely like for my sweet probate client, or even for my own family. My greatest hope for all of you is that you see your own worth, your own value in who you are in the lives of your loved ones; and I hope you realize that you deserve a story, a legacy, that will honor your life and be a blessing to all who knew you. Thanks for listening.

Why is the Pegasus our logo: https://burch-law.com/lorie-burch-bio/why-the-pegasus/

Have you ever noticed the word “plan” in estate planning? That’s a bigger deal than you may realize, but it addresses one of the greatest DIY estate planning and cut-rate law firm risks. There’s a reason we’re called “estate planning attorneys” instead of “Mad Libs lawyers.” This is just a matter of filling in words on a form and generating a document. I will tell you, however, that some of the DIY Wills we’ve read are just as funny and make as much sense as Mad Libs. But your family won’t be laughing when they find out that you left them with a mess. You don’t need a generic form that plugs in your names. You need a strategy, a customized plan that addresses your needs and concerns. You need guidance on what makes the best executor, how many back up guardians should you have, what is a smart way to leave money to your children, how should your beneficiaries on life insurance and retirement be set up to work with your plan…the list goes on and on!

Does everyone need a Will? Maybe not, actually! I mean there’s a 99% chance they do, but the point is that there may be instances where a certain “document” isn’t needed, but a “plan” is ALWAYS needed. An example could be a young adult just starting out in life who doesn’t have more than a car and a bank account; or someone who has really simplified their lives in retirement and only has life insurance and an investment account. Now, I don’t want to get too complicated and try to make the argument that a Will would help even in those situations, such as a Will could help if the family had to bring a wrongful death claim, but we’ll let the personal injury attorneys talk to you about that!

So, what do I mean about a plan? Early in my practice I had a very sad case of a woman in her early twenties who passed away and her parents were trying to get access to one single bank account that had a few thousand dollars in it. The bank, no surprise, was requiring them to jump through all these hoops. Now, we were able to resolve this in the end without any probate court involvement, but if their daughter had simply gotten the advice on adding a “POD” (payable on death) designation on her account, this would have never happened. Did she need a Will? Not in the end, but she did need advice on how to make a plan to make things easier for her parents during the most horrible experience of their lives.

No, we aren’t Mad Lib Lawyers, we are planners and it’s why no matter how “little” you think you have, you could probably use a plan to make sure you are going to make things as easy as possible for your loved ones. This could be options on how to set up life insurance or retirement beneficiaries, how to designate bank accounts, or even how to transfer your home.

Have a DIY Will and want to see if it will work for free BEFORE it’s too late? https://burch-law.com/diy-wills/

Here’s another one that comes to us by request…family that comes out of the woodwork! We’ve seen our fair share of “interesting” claims of people once someone passes away. What are some of our favorites? Let’s do a top 5 countdown:

5. With the increased popularity of genealogy tools such as Ancestry, people are finding out about all sorts of relatives they didn’t know they had! Fun? Sure! Legal heir to your estate? You bet!

4. Common law marriage – so did grandpa let his lady friend move in after grandma died? Great! Now she won’t move out and claims they were married!

3. Adoption by estoppel. I really don’t want to elaborate, because it triggers one of our probate attorneys, but just know that people can claim they were adopted without being, well, actually adopted.

2. So you gave your child up for adoption? Well, that doesn’t mean they don’t get to claim they should inherit your estate. That’s right, unless the child’s rights to the parent are also severed (this RARELY happens), then if you gave a child up for adoption or you otherwise surrendered your parental rights, they can still claim to be your child, and thereby inherit your money and assets!

1. Brace yourself, but this is our favorite, we had a probate case involving a daughter born from a threesome. One DNA test later, yep, he’s the baby daddy and she’s now his legal heir!

So what can you do about it? Gosh, I thought by now the answer would be obvious, but you need a solid estate plan in place, and you need to make sure you close any of these legal loopholes so you ensure your estate goes to your family of choice rather than by law!

Can you disinherit your family? https://burchlaw.dubb.com/v/PXB4zk

Special Edition: Common Probate Mistakes Part III

You would think in this day and age that a copy of a Will should be as good as the original. Well, you’d think that, but you’re wrong. There’s only one original! I know that can seem like a pain, but unless the law changes, you need to take REALLY good care of your original Will. Otherwise, the probate court may treat it as revoked and it will take all sorts of hoops, time, and money to prove you didn’t revoke it. And sometimes it even requires family you decided to cut out to consent to allow the Will to be valid!

Where should you keep your Will? First, where you shouldn’t:

- At your lawyer’s office. Now, maybe in the days of yore, this was common practice, but there are way too many issues with this to elaborate. What assurances do you have that the law firm will keep track of it if the practice closes or the attorney retires? How will the family know you have a Will and know how to contact them? What if you move? You get the idea.

- Where else is a bad idea? The county you live in. Again, maybe in yesteryear, this was a thing. But now we find more problems than not. What if you move out of that county? What if you update your Will, are you going to remember to get the other one back? How will your family know?

- Finally, another place I don’t recommend keeping your original Will is in a bank safety deposit box. This one may trigger some people and, hey, if you love this idea so much, then go for it. Just please make sure you ask the bank if you can add your family to have access if you die or become disabled, because they love to freeze those things and if the Will is inside, how are they going to get the authority without the Will? Also, have you heard of bank hours? I guess you had better make sure that you will only need access to your legal documents then. We actually had a client who couldn’t get access to her Will because the bank was closed indefinitely during the COVID shutdown.

We typically recommend keeping your original Will at home, preferably in a fireproof box. You should let your family or executor, if not the same, where you keep it, and you should make sure that a trusted person has access to your home for emergency access. Now your personal circumstances may dictate a different plan, which is one of the many reasons you should consult with a qualified law firm to help customize the best strategy...including where to keep your original documents!

For more tips on what to do once you have a Will: https://burchlaw.dubb.com/v/GH4jJg

Can you believe that we are almost at Day 31? I’ve got a few special things planned this week, so make sure you tune in. One of my last messages as part of this series is going to be about when to review and update your estate plan. So, you’ve listened to me…or someone else…and you actually got your Will and legal documents in place. But is it time to review and make changes? Here are some general tips on when to review or update your legal plan:

- Review your plan at least every 2-3 years. You want to ensure that you haven’t changed your mind about executors, guardians of your kids, or maybe your kids are over 18 and don’t need guardians, or you may want to change who makes medical or financial decisions for you. There are also changes in the law that you will want to make sure you are taking advantage of, such as including “digital assets” in your Will or financial power of attorney so that your Executor or Agent can handle online accounts such as email or social media in addition to your money and stuff.

- Have you moved out of Texas or to Texas? I am often asked whether documents from another state should be updated to Texas law. Y’all know we’re special here in Texas, don’t ya? Of course, you want to get your Will Texa-fied. While Texas does recognize Wills from other states, it will be easier for your executor to go through the probate process if your Will has language specific to Texas. Also living wills and medical and financial powers of attorney are all defined by state law, so if you want a doctor or bank to easily honor those documents, better get the Texas state seal of approval. Same goes for if you move out of Texas, but that’s obviously hypothetical, because who would ever dream of such a thing?

- Do you have everything you need? For example, I see many online forms and even other attorneys who do not provide all the documents that may be necessary for your wishes. We recommend that in addition to your Will, you should have a living will or directive to physicians, medical power of attorney, HIPAA medical record release, financial power of attorney, declaration of guardian for yourself, and an appointment of agent to control disposition of remains. If you have kids under 18, you should also have a designation of health care agent for children so someone can make medical decisions for them in case of emergency. Your Will only covers if you pass away, but this document covers if you are in an accident, in a hospital, traveling or unavailable.

You may also want to consider updating from a Will to a revocable living trust so your family and loved ones don’t have to go through the time and expense of probate court, whereas a Will is great and essential to make things easier, it still does have to be approved by a court.

I know, I know, it’s hard to get this stuff in the first place, but it’s time to do some adulting and as life changes, this too may need to change. The last thing I will add, now listen to me VERY carefully, you need to use a qualified attorney to update your documents. Do NOT, I repeat, do NOT write on your documents, or try to type it up yourself with changes. This will always fail. I promise.

When do I need to review and update my legal documents? https://burchlaw.dubb.com/v/WillTuneUp

Ok, everyone, we’re almost wrapped up here. In fact, today is going to be the last main message as Day 30 and Day 31 I have something special planned – you won’t want to miss it.

So how can I sum up the message here? When we started this journey 29 days ago, I told you it was because we have seen an increasing trend in people trying to do DIY Wills and estate planning, or taking what they think are short cuts, or just putting this off for one reason or another. We even have a number of people who take the time to contact us, meet with us, tell us they are ready to get started…only to become ghosts standing there in the room.

Here's a hard fact that I know about all the Burch Law ghosts – almost every single one of them still have NOTHING in place. No matter how well-intentioned, we know from experience that the longer they wait, the less likely this will get this done.

Nearly 70% of people do not have any plan and we’ve found that at least another 15% have a plan that won’t work, either is an online form, out of date, out of state, or they went to the cheapest law firm they can find, not knowing the time, money, and heartache they are creating for their loved ones in the end.

If you’ve been following long, then you’ve gotten a big dose of truth and reality. You have way more knowledge of what happens without a proper plan, the downside of DIY forms, what potential costs could be, and how the Texas probate system works. If you decide to do nothing with this knowledge, then I have news for you: YOU are the problem. It’s YOU.

You see, being an anti-hero is meant to be tongue in cheek and maybe, just maybe, it’s time to confront the worst version of yourself…

the one who procrastinates…

the one who thinks they can do legal planning on their own…

the one who thinks their family can just work it out…

the one who thinks it’s too expensive despite all the lesser important things you manage to find the money for…

the one who doesn’t want to face what it will do to their loved ones if they keep waiting…

the one who doesn’t see their own worth.

So my final message is this: you ARE worth it. Get this done SWIFTLY.

If you want to join our Friends of Burch Law Facebook Group for more tips and information, click here: https://www.facebook.com/groups/1294416854460964

It’s been a wild ride this month and I appreciate how many of you have shared, made suggestions, and reached out. I assure you that you are making a difference! So today, I want to “take that and rewind it back” meaning we want YOU to vote for your favorite(s) #31DaysOfTruthBurchLawEdition! Check out our previous posts and pick your favorites! We will discuss more tomorrow during our LIVE #31Days event!

Review and vote here: https://burch-law.com/31-days-of-truth/

Let Us Know Your Favorite Day(s)!

"*" indicates required fields