Ok, we get it, for many, there's a certain thrill in tackling projects yourself. From building IKEA furniture to trying out new recipes, the do-it-yourself approach can be rewarding.

Although my family knows to leave me alone while I’m trying to put together furniture, especially if they hear me shouting 4 letter words from another room.

But there are some things that if you mess them up, cursing isn’t going to make it better and you don’t even know you did it wrong until it’s too late. That’s right, I’m talking about trying to create your Will, trust, powers of attorney, and estate planning online or through Will kits.

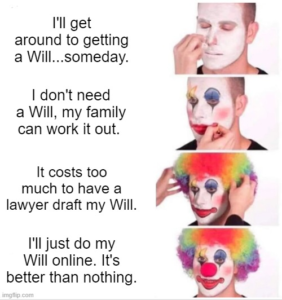

While the idea of crafting your own estate plan might sound tempting, there are some serious pitfalls you should be aware of before diving in. And if you think you’re going to save time or money in the long run, you are gravely mistaken. (Pun intended.)

Let’s talk about what can go wrong, because it rarely, if ever, goes right!

Get a free review of your current Will here.

Proceed with Caution: Understanding DIY Estate Planning Risks

Have you ever noticed the word “plan” in estate planning?

That’s a bigger deal than you may realize, but it addresses one of the greatest DIY estate planning risks. There’s a reason we’re called “estate planning attorneys” instead of “Mad Libs attorneys.” This is just a matter of filling in words on a form and generating a document.

I will tell you, however, that some of the DIY Wills we’ve read are just as funny and make as much sense as Mad Libs. But your family won’t be laughing when they find out that you left them with a mess.

You don’t need a generic form that plugs in your names. You need a strategy, a customized plan that addresses your needs and concerns. You need guidance on what makes the best executor, how many backup guardians should you have, what is a smart way to leave money to your children, how should your beneficiaries on life insurance and retirement be set up to work with your plan…the list goes on and on!

Common Pitfalls: Mistakes to Avoid in DIY Estate Plans

Okay, let's talk about the elephants in the room - the pitfalls of DIY estate planning. One major misstep is overlooking crucial legal requirements.

Imagine your heirs dealing with a mess of ambiguous language and contradictory clauses. Another common mistake is not keeping your plan up to date. Life changes – marriages, births, and even divorces – can alter your wishes. If your estate plan doesn't reflect these changes, it might be as useful as a leaky umbrella in a storm.

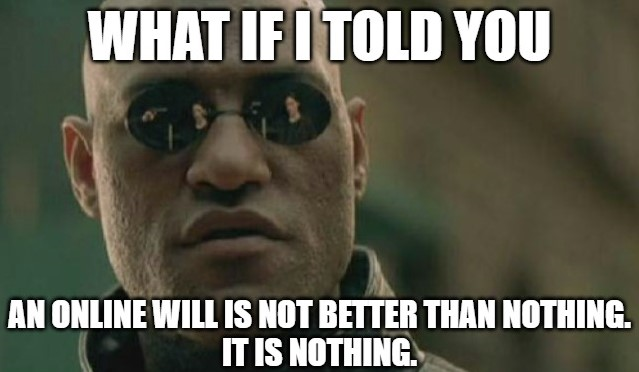

But do you want to know the biggest issue with DIY Wills and estate planning? Are you sitting down? They are rarely signed correctly. Like, 80% of the time at least. I know it doesn’t seem like it should be so complicated and, hey, we’ve been doing this work at Burch Law for decades, so it’s pretty simple to us.

Get a free review of your current Will here.

But nevertheless, time and time again, a loved one brings us a Will only to see that they thought it only had to be notarized with no witnesses, or the witnesses are family members, or it was never signed or witnessed at all!

I affectionately call this the tourist phenomenon.

Look, I think I’m a fairly intelligent person…until I travel. For some reason, put me in another city and I have no idea how to get on and off an elevator, or to cross a street, or to drive a car.

Well, my experience is the minute you put legal documents in front of someone, they freeze and forget all common sense and what it says plainly in front of them.

This is the only way I can try to explain how this continues to happen; otherwise, I’m going to lose hope for humanity if they continually can’t understand “Witness signature” means….for the witness to sign, not the notary.

Real-Life Cautionary Tales: Horror Stories of Poorly Executed DIY Plans

Ok, let’s say you are in the rare category of DIYers who actually got your Will signed correctly. I’m sorry, friend, but it’s still looking grim. Here’s just a brief sample of some of the horror stories we’ve dealt with when it comes to DIY disasters:

- Couple lost their homestead exemption because they didn’t include required language in a deed for their living trust.

- Husband assumed his wife would get everything, so his Will gave everything to his kids. His wife survived him, so his kids got his half of the home and money instead of her.

- Mother referred to “my children” without listing their names. The court required the appointment of an attorney ad litem to investigate the “heirs,” which cost thousands of dollars more and took several months longer. But that’s not all, it was discovered she had given a child up for adoption and, since she didn’t define who she meant by “my children,” that child also received part of her estate.

There are so many other examples we could give you, but hopefully, these are enough to highlight how badly DIY plans can go wrong.

The Expert Touch: Why Professional Guidance is Crucial in Estate Planning

Here's the deal – estate planning professionals have years of experience and legal knowledge under their belts.

They've seen it all (I hope I’m not tempting fate) and can customize a plan too fit your unique situation and goals. They know the ins and outs of state-specific regulations and can ensure your wishes are clear and legally sound.Remember, a solid estate plan isn't just for you – it's for your loved ones too.

fate) and can customize a plan too fit your unique situation and goals. They know the ins and outs of state-specific regulations and can ensure your wishes are clear and legally sound.Remember, a solid estate plan isn't just for you – it's for your loved ones too.

Imagine the relief of knowing you've left behind a well-structured plan that minimizes confusion and stress during an already emotional time. Now that is time and money well spent!

Get a free review of your current Will here.

Conclusion

So, dear readers, while DIY projects are all the rage, estate planning is best left to the experts.

The risks of DIY estate planning are real, and the potential consequences could be felt for generations. Instead of setting sail on the rocky seas of legal jargon alone, consider partnering with an estate planning professional.

Your legacy deserves the best, and sometimes, that means letting the experts take the wheel. Stay wise, stay informed, and here's to planning for a secure future – the smart way! And remember, if you don’t have a Will, the state of Texas has one for you!

Here's another reminder of how DIY Wills make us feel, just incase you missed it:

Click here to schedule your complimentary initial call with our team!